When you were a kid, did you ever get an extra scoop of ice cream and thought you were the luckiest person ever? Then, three-quarters the way through, you realized you couldn’t finish it and thought, “What a waste?!”

Too often, we have a disordered view of what good value is, especially when we are competing for customer loyalty. More must be better, right?

Not exactly …

The unintended outcome could very well be “more is less”: less profit, less exponential sales, and more waste. Let me explain.

Recently, I reviewed a restaurant for a casino property, expecting to find out why its food costs were rising beyond its potential estimates. Typically, I find many reasons for this, not just one, so I performed a full audit.

The first test was to review the restaurant’s menus and recipes to ensure they align and are listed correctly in the POS system.

- Does every item listed on the menu also listed in the POS?

- Does each menu item have a proper recipe?

- Are the recipe costs updated frequently?

- Are the menu items portioned to the recipe?

- Is the menu item in the POS the same item as the recipe?

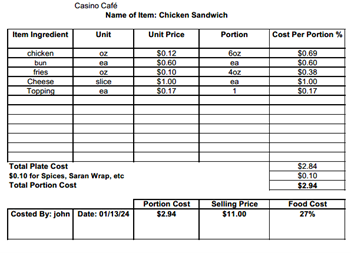

These items seem simple enough to verify, but there are often significant variances between the recipe and the actual menu item. For example, the chicken sandwich recipe shows a cost of $2.94, and compared to the $11 selling price, the food cost percentage is at a respectable 27%.

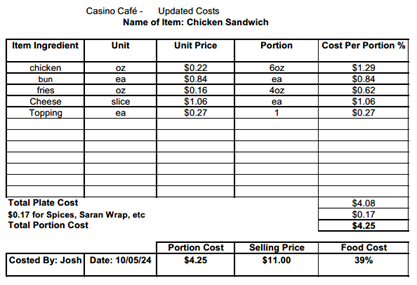

However, the item costs had not been adjusted in nine months, and the true recipe cost is as follows:

Menu items must be adjusted monthly to ensure that the cost still works. In this scenario, with all other things being accurate, menu pricing should be adjusted.

But there is more to this story.

The actual plate looked something like this:

Clearly, the portion of the French fries exceeded the 4oz shown in the recipe. When the actual portion was weighed, it came in at 12 oz—on every plate. The line thought that the large platter they put the sandwich on looked too empty, so they added more fries to the plate to make it look like a good value. The problem wasn’t the fries themselves but the fact that the extra fries weren’t accounted for.

Based on the recipe above, 4 oz of fries cost $0.62 a plate. The extra fries cost an additional $1.24, which was not included in the menu price.

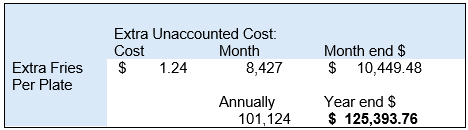

This restaurant sold 1,237 chicken sandwiches with fries in September. That month, it also sold 7,235 plates of burgers and other sandwiches with fries, totaling 8,472 plates, with an additional $1.24 of unaccounted French fries.

That means on an annual basis:

WOW!

The Chef and the F&B team were unaware that the plates were also coming back with tons of leftover fries on the plate, indicating that they weren’t even being consumed as anticipated.

This type of “plate creep” is dangerous if unchecked. After a full menu analysis of all their restaurants, we determined which items were popular and profitable and which items needed to be changed or removed. This type of analysis is crucial and should be done a minimum of once a year, but it could be done quarterly for optimization.

Immediate changes have now been made to portion sizes, plates, and menu costing. Thus far, customer perception has had little to no impact, and in some cases, guests have commented that they have appreciated the more balanced plate presentations.

Many other areas in F&B could lead to significant financial improvements just by reviewing the data correctly and running an audit of the following:

- Menu Analysis

- Purchasing Errors

- Revenue per seat

- Revenue per labor dollar per day

- Waste sheets

- Maximizing Seats in reservations

- Turnover costs

- Turns per period

- Beverage cost

- Wine markup strategy

- Labor costs

- Controlling miscellaneous costs

- Managing linen company pars

- Inventory management

- GSS Scores

Should you need assistance with any of these areas, please contact Raving for an audit.