The Blip

The Blip

In 2018, Hollywood gave us the cinematic blockbuster, Avengers: Infinity War, where the hated Thanos got his mitts on all the Infinity Stones and dissolved half the Marvel universe with a snap from his giant metal glove. In March of 2020, enter COVID-19, where, with a figurative snap of the fingers, all casinos closed and guests disappeared. But unlike the Avengers: Endgame sequel when Tony Stark brought everyone back five movie years later, simply reopening our casinos didn’t have the same effect.

Not Snapping Back

Not Snapping Back

COVID-19 casino closures ranged from 30 days to over a year. Most were in the two to three month range. With various restrictions, COVID-19 unknowns and a lack of team members and amenities, guests were slow to return. We hoped when vaccines were available, guests would return. We hoped when the plastic barriers came down, guests would return. We hoped when the mask mandate went away, guests would return. In reality, no casino sat idly by and “hoped” guests would return. Many marketing dollars were, and still are, being spent to re-engage those yet to return.

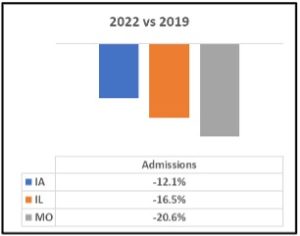

In many local and regional markets, despite a return of F&B offerings, full hotel room availability, entertainment and restoration of smoking areas, 2022 admissions are still down 10-20% from 2019. However, gaming revenue is up – in some cases, way up! Win per admission in those same markets is up 15-30%. So, should we care about guests still missing after the Blip?

Data Will Guide Us

The answer is yes. We should care because there is indeed data gold to be mined, and if we mine properly, we can identify those with the greatest likelihood of returning at profitable margins. Start by focusing on all guests with a last visit within three to 12 months of the Blip with a historic ADW north of a number that makes sense fiscally for your property. There is always past due churn, so next, work on establishing individual play patterns so that you can separate standard attritors from Blip attritors.

If your property has an active social gaming product or you operate an online casino, bounce your list against those to check for activity in the virtual world that may have grown or evolved during the Blip. You can also work with your FINTECH vendor or outsource with an external vendor to see if anyone on your list is popping up on recent ATM transaction lists at your competitors. Just know that when you go that route, you may have to work with those vendors under an overall reactivation contract strategy with a rev share plan.

At this point, you should be fairly confident that you’re left with a list of folks driven away by the pandemic, with historic propensity to game at an attractive level, yet to return to gaming. That will most likely still be a signficant number.

Part Two

So now what? You could execute a typical reactivation direct marketing campaign with standard offer package based on common past due segmentation strategy and “We Miss You” messaging. Guess what? It’s boring. I don’t blame our guests for ignoring that, because I can guarantee your database manager has already hit this audience using that approach three to four times by now and garnered a one percent response rate. Time to take it up a notch with cluster analysis to discover what this group has in common, in hopes of identifying new ways to connect with this audience. Yes, it may seem like a lot of brain damage for little gain, but moving the response rate up to just five percent will reactivate long-term incremental gains.

In our article sequel, we will elaborate on the various clusters, the marketing approach and communication channels used for each, and the results of those efforts relative to control groups. Stay tuned.

Steve Dahle serves as the Chief Innovation Officer for Mille Lacs Corporate Ventures and has been a Raving Partner for 3 years. Mille Lacs Corporate Ventures is owned by the Mille Lacs Band of Ojibwe and manages its numerous businesses, including Grand Casino Mille Lacs, Grand Casino Hinckley, the InterContinental Saint Paul Riverfront Hotel, the DoubleTree Hilton in St. Paul, Minn., the DoubleTree by Hilton Minneapolis Park Place in St. Louis Park, Minn., Embassy Suites by Hilton Oklahoma City, SLOTCO, Makwa Global, Big Sandy Lodge & Resort, Eddy’s Resort, and other businesses such as a commercial laundry facility, cinema, a grocery store, gas/convenience stores, a golf course, and a wastewater treatment plant.