By Kevin Huddleston, CPA, CGMA, CFF, Partner, Finley & Cook and Raving Strategic Partner — Accounting and Auditing and Brett Magnan, Raving Partner, Hospitality

Today we’re talking about weighing the importance of capturing the correct and accurate data for reporting purposes, through proper cost controls and standard operating procedures.

Peter Drucker, business guru and author of over 39 books on the subject, said, “If you can’t measure it … you can’t improve it.” I would suggest that “If you can’t measure it accurately … you can’t improve it.”

When Kevin and I review a property’s performance, one of the first things we ask for is a copy of their standard operating procedures, checklists and reporting logs. We do this to ensure that both leadership and line-level team understand the importance of capturing the correct data for reporting. Bad data in – results in bad data out.

Areas specifically concerning in food and beverage are: the lack of capturing waste/spoilage, poor inventories, comps, and improper costing of menus. These issues carry through to the casino in player comps and discounts, as well as the hotel with comps and lack of capturing added costs and lost revenues. For this exercise, we will show you a food and beverage example showcasing how bad data can negatively affect your reporting.

Let’s define each food and beverage detail:

- Waste/spoilage logs: These are typically located on a clipboard in several areas of the kitchen and server prep area. These logs are designed to capture when a plate is dropped, food goes bad or is left out longer than expiration or health regulations allow, over-pours or over-produced and unable to serve to a guest. These are typically items that cannot be sold to a guest and if not tracked, just inflate the cost of goods or food cost percentage to sales. This log should be calculated at cost, tallied and submitted at month-end to accounting with inventories.

- Poor inventories: Typically, inventories are taken consistently by the same two individuals each month; one person from accounting and one person from the kitchen. A poor inventory occurs when new individuals don’t read the counts the same way as previous months have been, affecting accuracy. In addition, not completely capturing every item required will affect COGS. Cost of items not updated from invoices to inventory sheets will also inflate or deflate values. Another inventory related item that can distort COGS is invoices for deliveries not being sent to accounting in a timely manner.

- Comps: These are either authorized comps for players, guest recovery, promotions or staff trials for educational purposes. These items must be either rung into the point of sale system (POS) or logged in a spreadsheet and submitted at month-end for accounting.

- Improper menu costing: This occurs when a menu was costed out for too long a period of time and does not account for menu changes, inflationary changes in purchase cost, or portion sizes. This last area is the most damaging to food cost percentages to revenue as menu creep and waste both increase for twice the damage to the data.

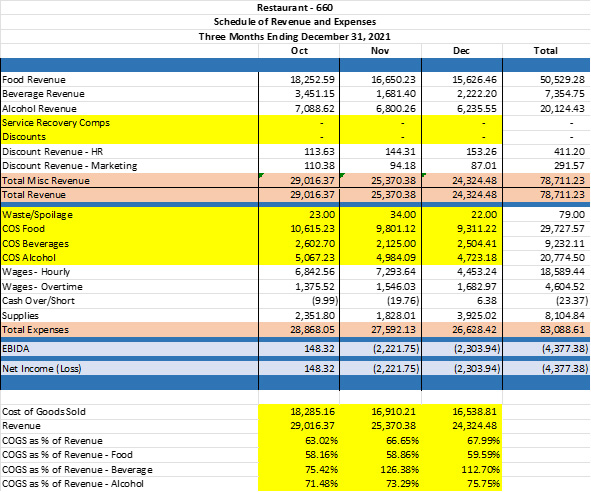

Using the above issues, here is how it shows on the schedule of revenue and expenses when not accurately captured. (Example 1)

In the above example, no comps or discounts were reported for the three months, ending December 2021. Also, waste/spoilage was extremely low. Without accounting for those items, the cost of goods sold (COGS) and related percentages were inflated higher than what should have been accurately reported. Those that are measured on maintaining proper food or beverage costs will take issue with such a significant variance to what should be reported.

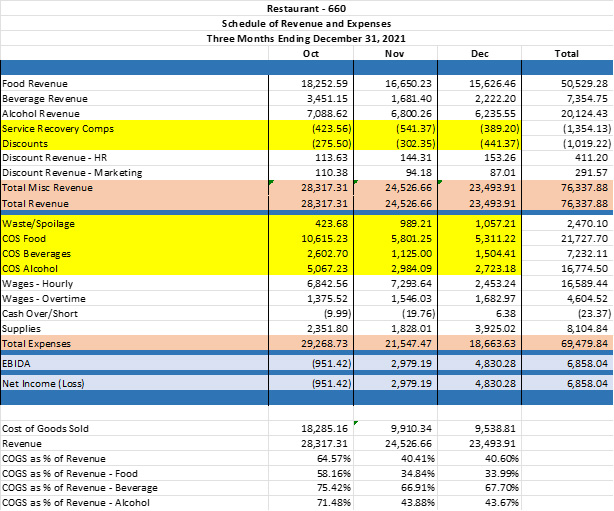

In the example below, you will note that with proper capture of these items that there is a much better picture of what is going on in the operation. (Example 2)

In this scenario, comps and discounts have been accurately reported and captured. Waste/spoilage has also included every item and significantly changes the expense lines.

October inventories show higher than expected, due to poor carryovers from previous month actuals, but have been corrected in November and December, improving the individual and overall COGS percentages.

Whereas Example 1 shows a significant loss in this restaurant’s numbers, Example 2 improves the P&L to a somewhat more respectable performance with positive net income.

The added bonus to correctly reporting these four items is that you now have an additional tool in measuring them because they are reported properly. If your comp line seems high or low – that can be addressed specifically in how your business should be comping guests. If your waste logs vary significantly from month to month, you can find out if there was a specific event that created the extraordinary expense or a change in your SOPs that would address the higher trend.

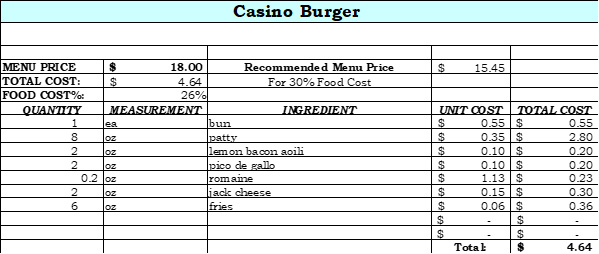

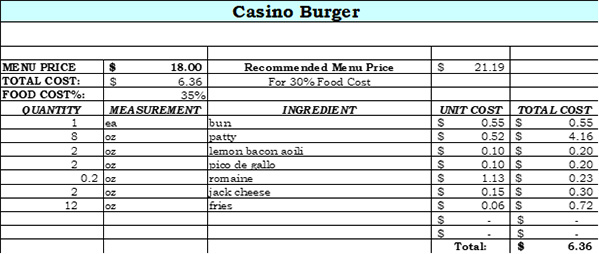

The more difficult item is menu costing errors and portion controls. The visual below illustrates how one item can affect the restaurant’s costs over a one year’s time.

They costed out their “Casino Burger” at 26 percent food cost, based on the value of each ingredient on the plate. The burger is a large portion, consisting of a ½ pound of Angus ground beef and 6 oz of fries. Based on this costing, the menu item is a “star” in sales performance. However, the actual cost of the meat has increased from $0.35 an ounce to $0.52 an ounce due to supply chain issues and the cost of beef skyrocketing. The fries portion has grown from a portioned 6 oz to 12 oz because the line cooks fill the entire plate with fries without measuring. Seems minor enough … The plate cost goes from $4.64 to $6.36, and now food cost percentages are out of line. This restaurant sells 100 burgers a day and on an annual basis that $1.72 of menu error cost the restaurant $62,780 of uncaptured expense. Multiply that error throughout the entire menu and we find a significant cost improvement opportunity.

If you want to have better insight into the profitability of your food and beverage operation, ensure that you are collecting good, timely data. Capture good waste and spoilage data. Make sure that you have accurate, timely inventories and quickly forward invoices to accounting. Record all comps, whether earned or service recovery in nature. Regularly check the costs and portion sizes of items used in preparing and costing each menu item. These relatively simple things will help you better manage your food and beverage operation for maximum profitability