This past August was an interesting month with the opportunity to start traveling a bit more to casinos around the country, as well as having some limited meetings on-site with clients again. As I write this article, it is hard to say what the Delta variant’s effect on the industry will be as we again try to stay open. That being said, it is surreal to look back at the past 18 months and ponder the pandemic and all of the effects that it has had on our industry, from furloughs to record revenues in almost every jurisdiction. As I sit here and review data from around my clients in the industry, I wonder just how much our actions have affected business over the last six months, or if we are just lucky bystanders reaping the success of macroeconomic effects.

Four Guest Metrics to Look At

When evaluating any database to understand the health of a casino business, I largely look at four core guest metrics to understand growth or decline. Although there is a multitude of ways to slice and dice these statistics, at the core are the number of players, the number of trips or average trip, coin-in or volume wagered, and theoretical win, which will tell you everything an operator needs to know about the health of the rated database.

Understanding those core statistics and to try and not sound too alarming, every database that I have looked at over the course of the last six months has shown a significant degradation in the quantity of players and the quantity of trips versus what was normal in 2019. This means that all the record revenues we have recorded are coming from the same core players we’ve always had, and now they either have more money or more time, thus generating more revenue. This simple fact means that it is more important than ever to understand your inactive strategy and what you are doing in each casino marketing discipline to help reactivate those players.

Get Excited About Your Inactive Program

Unfortunately, it has been my experience that these very inactive programs usually get managed from the corner of a desk or, potentially even worse, just get put on repeat month-to-month. Today I am going to make it my mission to get you more excited about an inactive program, understand the cost of defection, and hopefully help you as an operator to create a better and more effective program that helps stop defection, and if it occurs, gets those players back into the casino.

Unfortunately, it has been my experience that these very inactive programs usually get managed from the corner of a desk or, potentially even worse, just get put on repeat month-to-month. Today I am going to make it my mission to get you more excited about an inactive program, understand the cost of defection, and hopefully help you as an operator to create a better and more effective program that helps stop defection, and if it occurs, gets those players back into the casino.

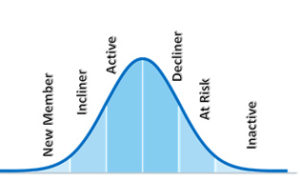

However, before we do that, let’s chat for a minute about the guest lifecycle and the habits of players as they move through the lifecycle curve. Most casino marketers are familiar with the terms New Member, Active, and Inactive. However, there are several other core segments between each group that we have already heard of. These include Incliners, or those players who are moving up in the number of trips and theoretical spent at the property after being a new member. Decliners, or those players who have a decreasing number of average trips or average theoretical from the prior evaluation period. Then finally, At Risk players or those who are on the cusp of becoming inactive or defecting. Within each of these segments, we are dealing with player habits and are actively trying to either create or re-establish former habits. It is these changes in habits that allow us to evaluate, identify and influence changing behavior more quickly.

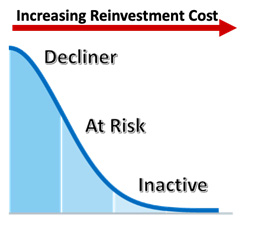

Now that we know that we need to catch these habits more quickly, let’s talk about definitions for each of the declining groups that we mentioned above. Our recommended segmentation criteria for a Decliner, At Risk or Inactive player varies by market, but can usually be defined as follows for local and regional operators. For Decliners, we typically use the measurement of monthly average trips and a decrease of 25 percent or more in a negative direction from the prior period to classify these individuals. At Risk players are typically identified as having a decline of 50 percent in average monthly trips from the prior period. Finally, Inactive players are identified as having no play versus the prior evaluation period and can typically be further divided into months since last play (e.g, zero trips in six to 12 months). Each of these segments is incredibly important to define and attempt to change habits as the reinvestment cost to reactivate these players increases exponentially as a player moves through the declining segments.

Now that we know that we need to catch these habits more quickly, let’s talk about definitions for each of the declining groups that we mentioned above. Our recommended segmentation criteria for a Decliner, At Risk or Inactive player varies by market, but can usually be defined as follows for local and regional operators. For Decliners, we typically use the measurement of monthly average trips and a decrease of 25 percent or more in a negative direction from the prior period to classify these individuals. At Risk players are typically identified as having a decline of 50 percent in average monthly trips from the prior period. Finally, Inactive players are identified as having no play versus the prior evaluation period and can typically be further divided into months since last play (e.g, zero trips in six to 12 months). Each of these segments is incredibly important to define and attempt to change habits as the reinvestment cost to reactivate these players increases exponentially as a player moves through the declining segments.

Influence New Habits

Now that we have defined our segments and we understand the importance and cost of reactivation, what can we do to influence the changing habits by using our most effective tools as casino marketers in player development, direct marketing, and marketing research?

Player development is the obvious first place to start when it comes to looking at those players who have a declining behavior. Casino hosts typically have unique relationships with those players who are assigned to them. It is for this reason that tasking hosts with declining players should be a key component to every player development incentive program. This directly ties the hosts’ compensation with their ability to talk to and remedy declining behavior and move them back to the active database.

Direct marketing is the logical next tool to look at when building a reactivation program. Although it will never be as effective as a one-to-one relationship as with player development, it is incredibly efficient to reach a large number of players. When considering offers for Decliners, At Risk players and Inactive players, it is important to remember that a habit was broken for one reason or another. Therefore, it is going to take an offer with enough value to pull them away from the new habit that has been formed. Thus, we like to build an increasing reinvestment model as players move from Decliner to At Risk and an even higher rate of reinvestment as they move on to Inactive. The key is to catch players quickly with your algorithm to keep them from moving further into the curve.

Finally, when evaluating declining players, much of the time the reason for the break in the habit loop is a who or a what at the property. Those properties that don’t have robust feedback programs from their hosts or a planned-out market research methodology are fighting a battle without knowing all of the facts. We often encourage our clients to make sure that Declining, At Risk, and Inactive players are just as much a part of focus groups and surveys as the Active players. In fact, many times the knowledge gained from this research proves much more valuable than that from your Active everyday player. When doing research and a who or a what is found to be the culprit of declining behavior, act quickly and swiftly to fix the problem. Players notice, and making those changes can often help keep a player from fully defecting to another property.