It has been several years since the last time I was asked to write an article, and quite frankly, I have started and stopped this article two or three times over the past week as I have thought about analytical issues that face the industry. The funny thing is that the subject finally smacked me straight in the face while conversing with a good friend who manages human resources at a location I have worked closely with for the past several years. That’s right, let’s tackle the issue that seems to not only be plaguing the casino industry, but businesses around the country as a whole: hiring.

Every casino department manager knows and understands the importance of data and what key performance indicators directly affect the outcomes and success or failure of their operations.

Marketing directors are constantly looking at guest reinvestment, food and beverage have cost of sales and inventory turnover, the slots department has win per unit per day and revenue per square foot. With all of that said though, why does it seem like the only thing that we as casino managers meaningfully measure in the human resources department is turnover and the cost of benefits compared to salaries and wages?

If you sit back and think, really think hard about the most important investments or money spent by your casinos in the last 10 years, my best guess is that you will arrive at a “who” and not a “what.” In fact, in a recent IBM CEO Survey, 71 percent of CEOs from across multiple industries stated that human capital is the most critical asset in creating sustainable guest growth. With that being said, why is human resources usually the last one to receive any sort of capital budget to monitor results properly? Furthermore, if acquiring this talent is considered imperative, why have I never seen a hiring dashboard talking about the KPIs of developing the right talent and how they arrived at your casino in the first place?

Believe it or not, in almost every human resources department, there is some fundamental data that can create human resources’ own crystal ball.

Believe it or not, in almost every human resources department, there is some fundamental data that can create human resources’ own crystal ball.

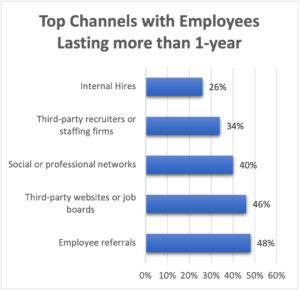

“What is that?” you ask … the channel used to find each of your current team members. If you don’t have that information, it’s alright, it turns out that you have the opportunity to ask each and every day that your team members walk through the door. With that being said, most casinos that I have been to in recent history have a similar spread to this 2017 LinkedIn study.

Just imagine what you can do with this data, you know exactly where to invest dollars to attract the right, long-term team member who wants to be at your casino and develop relationships with your guests. Furthermore, let’s take a second and track this by department, now the human resources manager and the hiring manager are not left guessing about where to post a job or who to recruit. By the way, based on these survey results, those Fortune 500 companies that are talking about hiring frontline team members right now, they are finding the most success in using their current workforce as a recruitment firm. Disney (I know, it is a love-hate relationship) recently said that offering current team members recruiting bonuses of up to $500 and matching it for the new team member has helped ease labor market challenges.

Now that we have built our crystal ball that determines where to get our new team members, the fun can begin. Now just imagine hooking this data to job performance data, promotion data and tenure. Wouldn’t it be nice to find where a team member came from who had the longest tenure, performs the best and has the lowest starting wage? That almost sounds like an equation for return on investment, and we all know that is how to find capital dollars.

Data is not just for the revenue-generating departments and looking at a human resources dashboard is equally as important as reviewing slot performance data or understanding the active mailer.

It is impossible to get better at hiring if you don’t know how to find the right candidates and if the source they came from leads to a good team member. If you don’t have a blueprint (data and insight), it is impossible to know what you are trying to build, no matter the number of tools in the toolbox.

It is a tough job market out there. Make it a little easier on yourself, and let the data be your guide.