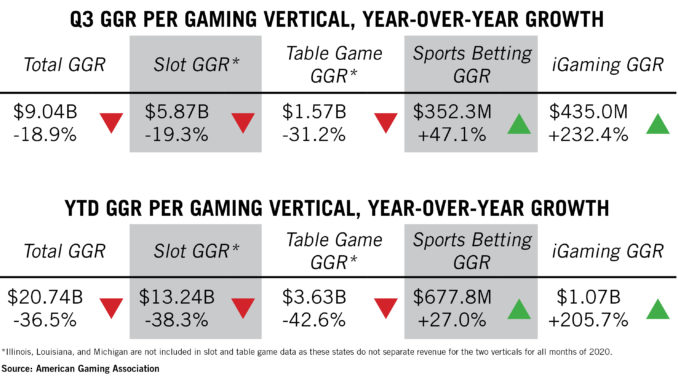

WASHINGTON – November 16, 2020 — U.S. commercial gaming revenue for Q3 2020 totaled $9.04 billion, reaching 81 percent of the industry’s pre-COVID levels in Q3 2019, according to the American Gaming Association’s (AGA) Commercial Gaming Revenue Tracker. Q3 revenue is up 294% from the historic lows of Q2, caused by pandemic-driven, mandatory closures.

COVID-19 health and safety measures, including social distancing and capacity restrictions, have contributed to the gaming industry’s recovery lagging the country’s broader economic recovery. Gaming revenue is down 36.5 percent year-over-year (YoY) in the first nine months of 2020, compared to the U.S. GDP’s three percent decline in the same period.

“Our industry continues to prioritize the health and safety of our employees, customers, and communities above all else,” said Bill Miller, AGA President and CEO. “While these quarterly results are promising, the reality is a full recovery is dependent on continued public health measures to control prevalence rates.”

“As state and local officials respond to current COVID-19 outbreaks with additional restrictions, urgent Congressional action to provide COVID-19 relief is even more crucial. Gaming employees and communities depend on it,” Miller added.

More than 100 casinos reopened between July and September with 902 commercial and tribal casinos (90.8% of total) operational by the end of the third quarter, compared to 800 (80.8% of total) at the start of July.

Many states that saw encouraging gaming revenue growth in Q2 continued the positive trend in Q3 despite continued capacity restraints. Five states—Arkansas (+.3%), Mississippi (2.8%), Ohio (+7.5%), Pennsylvania (+3.8%), and South Dakota (+6.1%)—outperformed their Q3 2019 revenue figures. Looking only at the most recent month, September, the recovery trends continue with both Maryland (+1%) and New Jersey (+6.5%) also returning to YoY gaming revenue growth.

While nationwide slot and table game revenue remained down compared to Q3 2019, sports betting revenue bounced back in Q3 2020, bolstered by an unusually crowded sports calendar and strong consumer interest in new legal betting markets in Colorado, Illinois, Michigan, and Washington, D.C. Americans legally wagered a record $5.95 billion in Q3, generating $352.3 million in gaming revenue—the second highest ever quarterly total.

iGaming continued to grow in Q3 2020, due, in part, to West Virginia launching in July. iGaming generated $435 million in Q3, up eight percent from Q2 and 232 percent from Q3 2019.

Background

To date, 911 of 994 U.S. casino properties across 40 states have partially reopened. This includes 442 commercial casinos (94.7% of total) and 469 tribal properties (89% of total).

Michigan Governor Gretchen Whitmer announced a mandatory re-closure of casinos on Nov. 15, effective Nov. 18. Since late October, other states have taken steps to introduce overnight curfews or further restrict casino capacity.

The AGA’s COVID-19 casino tracker is updated daily and lists the reopening status of every U.S. casino.

About the Report

AGA’s Commercial Gaming Revenue Tracker provides state-by-state and cumulative insight into the U.S. commercial gaming industry’s financial performance based on state revenue reports. This issue highlights third quarter results, ending September 30 (Q3 2020), and year-to-date comparisons.

About the AGA

The American Gaming Association is the premier national trade group representing the $261 billion U.S. casino industry, which supports 1.8 million jobs nationwide. The AGA members include commercial and tribal casino operators, suppliers, and other entities affiliated with the gaming industry. It is the mission of the AGA to achieve sound policies and regulations consistent with casino gaming’s modern appeal and vast economic contributions.

###